Tax Reforms: A Summary

During the 2016 election, Donald Trump promised the American people that he was going to cut taxes for middle class citizens. This was a key component of his presidential race and some may argue that it is the reason he won the election.

On September 27, 2017, eight months after his inauguration, President Trump presented the Tax Cuts and Jobs Act to Congress. One month later, on November 16, the House of Representatives passed their version of the act then a mere two weeks following their vote, the Senate passed theirs.

To summarize, the Senate’s plan cuts corporate tax rates from 35 percent to 20 percent, by 2019, whereas the House’s plan does it one year sooner; however, in order to find revenue to pay for other tax cuts, they may raise the rate to 22 percent. Both plans cut income taxes, double standard deduction and eliminate personal exemptions.

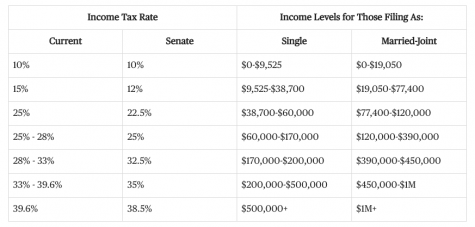

As is, there are seven tax brackets. The Senate’s plan keeps the current brackets, but lowers tax rates.

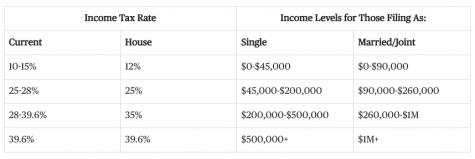

The House’s plan leaves us with four tax brackets, with lower rates in three.

Both plans eliminate itemized deductions, which is a tax deduction from one’s adjusted gross income from expenses on certain goods and services. These can decrease taxable income and are claimable in place of standard deductions.

As of 10 AM on December 13, both the House and Senate bills have been in conference. House and Senate Republican negotiators have come to an agreement on the tax bill, but there are still several smaller issues to work out.

President Trump believes the tax reform is an urgent matter and has pushed for a bill to be on his desk by Christmas; however, several sources say that Republicans could lock in their final deals as soon as the end of the week.

If a tax overhaul becomes federal law, it will represent the most significant tax reform since 1986. However, there is a debate over who are the winners and who are the losers in this reform. In short, low, middle, and high-income households are winners.

The plan eliminates the Alternative Minimum Tax, which offsets deductions that a person with high income could potentially receive, when they file their taxes. “The plan doubles the standard deduction, which reduces the amount of taxed income, to $12,000 for individuals and $24,000 for married couples, making low-income taxpayers a winner”, Steve Odland, CEO of the Committee for Economic Development, told Fox News. The plan also increases child tax credit, which is beneficial to all families.

With great benefits come great downfalls. Taxpayers in high tax states will fall victim to this plan because it eliminates state and local tax deductions. This will mostly impact California and New York. Congressional Republicans from New York and New Jersey, upset over this provision, have warned that they will reject the tax bill.

If the Tax Cuts and Jobs Act passes, economic growth will peak. The Act will lead to more jobs, higher wages, and a higher standard of living for American citizens. If the bill fails, the United States risks a continued economic downfall. The Senate and House both oppose ideas submitted by the other, which can cause a stalemate in the process.

The idea is to make the process of filing taxes easier on the American people; however, who is really winning here? The passing of a bill takes time and it may be another year before we see reforms. The best we can do as citizens is remain patient with our government and remember that they have the best interests of our country in mind.

Hey Spud buds! My name is Safyre Yearling! I am the 17 year old daughter of the late Amanda Preiss and Lance, and my amazing mother figure, Mandy. I am...